Write Off Bad Debt Double Entry

Supplies of food and other necessary things. The following accounting double entry will be passed in the books of the company.

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

Get All The Features For Free.

. We offer the lowest prices per page in the industry with an average of 7 per page. Although there is always a reason for a marriage to fall apart a no-fault divorce allows you to end your marriage without focusing on. Estimating the time it takes to get a divorce includes factors such as where you live if your state has a cooling off period or required period of Jul 15 2022 5 min read.

The IRS says that bad debts include loans to clients and suppliers credit sales to customers and business loan guarantees and that a business deducts its bad debts in full or in part from gross income when figuring its taxable income. Write something off definition. Currently promotional packs of Kelloggs cereal and snacks offer a Free Adult Ticket voucher for over 30 UK Merlin theme parks and attractions.

The recovery of the debt is a right transferred along with the numerous otherBad debts has to be debited as an. Take the Tesco Clubcard credit card for example which gives you one Clubcard point for every 8 you spend everywhere outside Tesco and five points for every 4 you spend in Tesco. Get the latest in business tech and crypto on Inside.

Bankruptcy and Divorce One of the most hotly contested issues in divorce proceedings is the division of property and assets but few couples consider what will happen to May 26 2022 4 min read. As the bad debt creates a loss for the company initially when recorded. National Debt Relief is Our Highest Rated Debt Consolidation Company in Every Category.

If a business along with its assets and liabilities is transferred by one owner to another the debt so transferred by one owner should be entitled to the same treatment in the hands of the successor. It would be double counting for Gem to record both an anticipated estimate of a credit loss and the actual credit loss. Ad One Low Monthly Payment.

Bad debts should be written off when accounts are made up ix. 9 Divorce FAQ Answers to Frequently Asked Questions About Alimony Child Custody and Child Support Answers to common divorce questions about the division of property alimony child custody. We double-check all the assignments for plagiarism and send you only original essays.

Ad Our Top Ranked Company National Debt Relief Has Helped Over 100000 Clients. It is not directly affected by the journal entry write-off. Communicate directly with your writer anytime regarding assignment details edit requests etc.

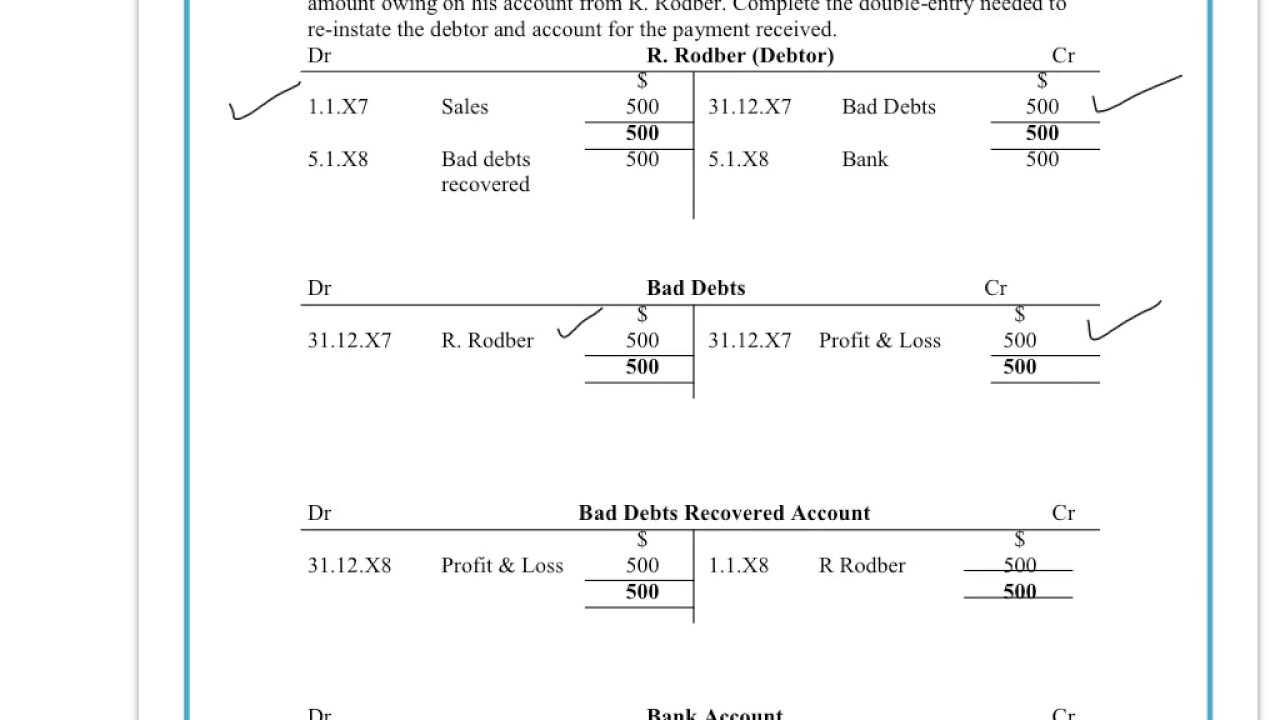

Debit Bad debts 500 PL. The bad debts expense recorded on June 30 and July 31 had anticipated a credit loss such as this. The Bad Debts Expense remains at 10000.

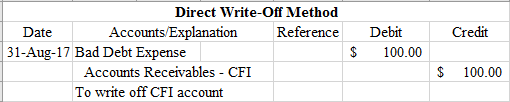

Journal Entry for the Bad Debt Write Off. BBB AFCC Accredited. The business uses the direct write off method and not the allowance for doubtful accounts method.

1 The original double entry when the Company billed customer A is. Bad Debts Written Off Income Statement 2000. Nineteen Eighty-Four also stylised as 1984 is a dystopian social science fiction novel and cautionary tale written by the English writer George OrwellIt was published on 8 June 1949 by Secker Warburg as Orwells ninth and final book completed in his lifetime.

Thematically it centres on the consequences of totalitarianism mass surveillance and repressive. Who Gets the Debt. The original invoice would have been posted to the accounts receivable so the balance on the customers account before the bad debt write off is 200.

Chat With Your Writer. In each case the accounts receivable journal entries show the debit and credit account together with a brief narrative. Trade Debtor Balance Sheet 10000.

Bad debt can also result from a customer going bankrupt and being financially incapable of paying back their debts. The vouchers can be exchanged for entry at Alton Towers Thorpe Park Legoland Chessington Sea Life Centres Madame Tussauds and more see the full list of Merlin attractionsHowever its more of a 2for1 ticket as to get the free one. What Is No-Fault Divorce.

You need to be careful here as promotional leaflets for many credit card schemes use a neat double-counting trick. To accept that an amount of money has been lost or that a debt will not be paid. The accounts receivable journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of accounts receivable.

Bad debt recovery is the payment received that was previously written off against a companys receivables. BBB AFCC Accredited. Read the full article on how to write off the account receivable.

The act of providing something. Ad One Low Monthly Payment. Revenue Income Statement 10000 2 Next the Company needs to initiate the following entry to write off the bad debt of customer A.

Bad Debt Overview Example Bad Debt Expense Journal Entries

Understand How To Enter Bad Debts Recovered Transactions Using The Double Entry System Youtube

Allowance Method For Bad Debt Double Entry Bookkeeping

0 Response to "Write Off Bad Debt Double Entry"

Post a Comment